India’s unbanked population has been the target of the government’s flagship Pradhan Mantri Jan Dhan Yojana (PMJDY), or the Prime Minister’s People’s Wealth Program, launched in 2014. It has been largely responsible for the rapid increase in opened accounts, the Global Index report said.

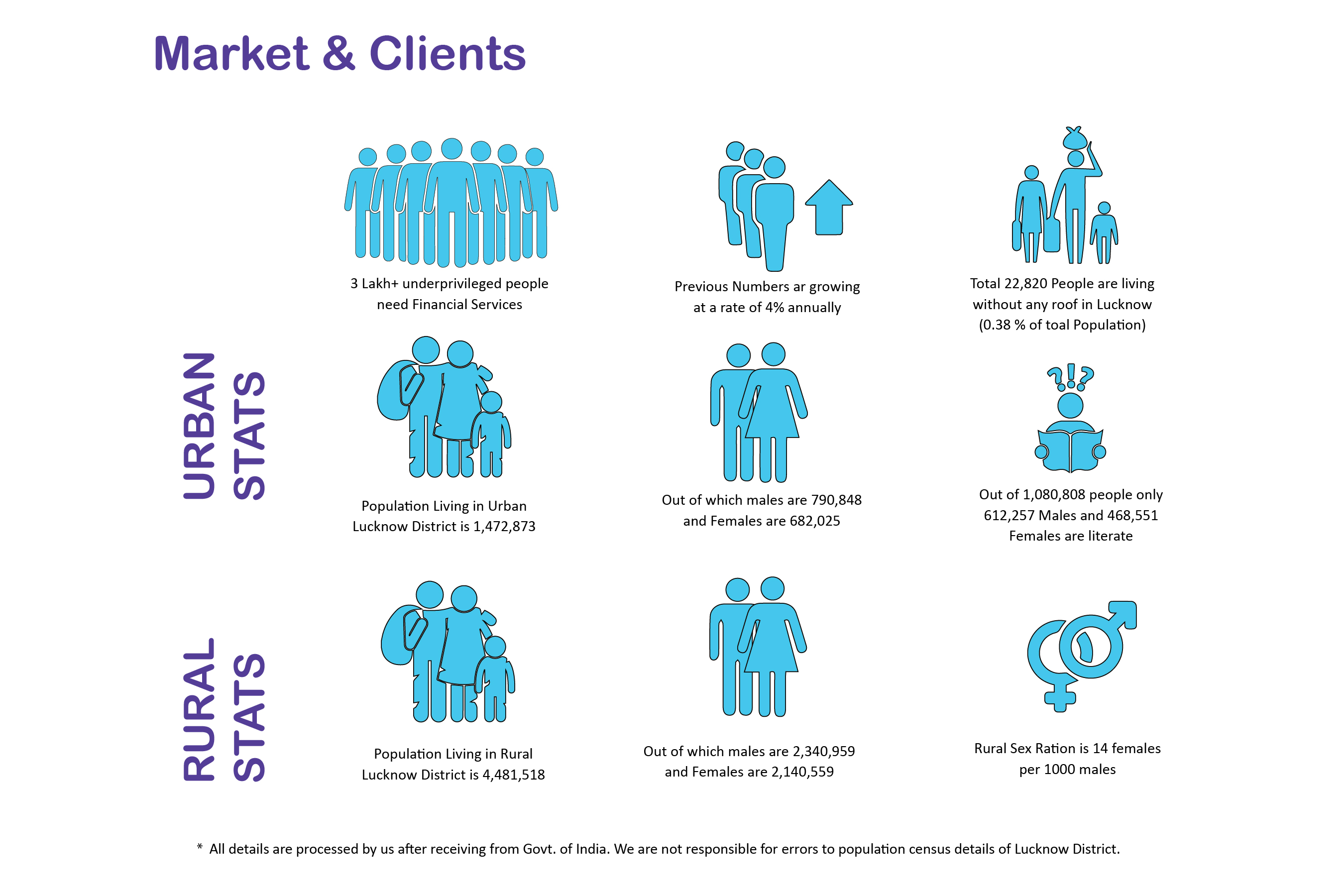

Our intend is to increase opportunities for the poor to access financial services by providing financial services to low-income entrepreneurs, mobilizing deposits from members and non-members.

Finlife India core values are enhancing their clients ‘self-determination, serving as an ongoing financial resource for members, and achieving significant outreach and financial self-sufficiency.

At the end of 2023 will plan, Finlife Tech (India) Private Limited started a pilot program and offered a Home Loan, Two- Wheeler Loan, personal loan through banking code and financial literacy program. The institution required all borrowers to maintain monthly compulsory savings, which is treated as part of the loan product. Finlife Tech (India) Private Limited will be seeking to the pilot results compulsory saving and proper loan utilization & intends to follow up with this loan type but plans to introduce new loan product in next year when they extend their business to that region. The product should be customized based on the needs of income generating and small-scale business’ purpose and their tactics.